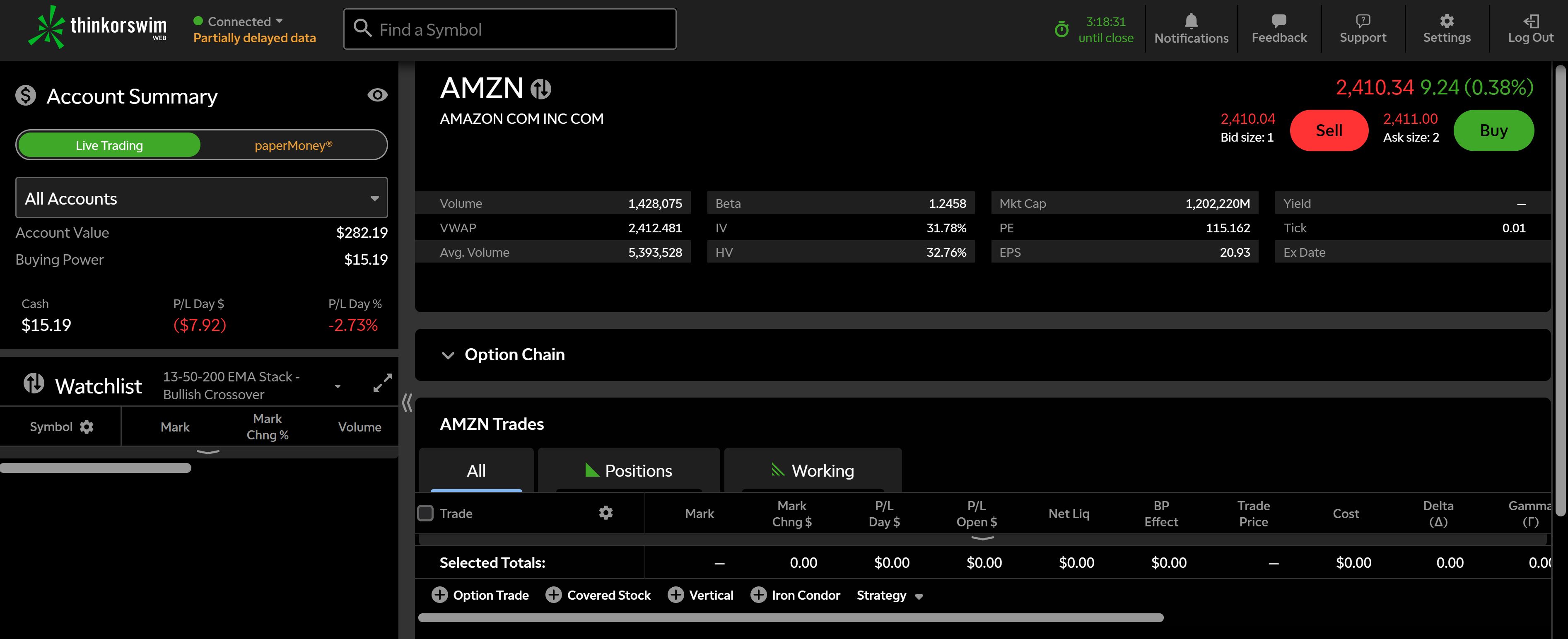

if the trader enters the market at a superior position to what they requested, which is welcome of course. if the trader enters the market at an inferior position to what they requested.Positive slippage, i.e. Naturally, there is always going to be a time delay between the trader buying or selling a financial instrument, and the time that the broker is able to execute the order, even if it’s only a few milliseconds, the delay is still there.Why Slippage is an Issue in FX Trading The issue of slippage is exacerbated in high volatile markets, such as the foreign exchange market in particular, as prices can and do change within these few milliseconds, causing the order to be executed at a different price to what was originally requested. For example, in forex trading, if a trader places a trade intending to enter a buy on the EUR/USD at 1.1080, but they only get into the market at a price of 1.1078, the slippage here would be two pips. Many traders view levels of slippage at brokers as a key determinant for their business. Slippage is a very contentious issue among retail traders, which can lead to issues. In financial trading, slippage refers to the difference in price between the price an order was intended or expected to be filled and the actual price an order was filled. Thinkorswim Web can be accessed using any internet browser and retains all the features of the original platform, including the ability to execute orders directly from real-time charts, live streaming quotes and real-time news, advanced order functionality, and Slippage

The new web terminal provides easy access to equity and derivative markets, combining uncomplicated trader functionality with an advanced graphical user interface and a synchronized experience on any device, the company says. Additionally, demand by traders has led to a greater emphasis on newer features such as advanced charting and other tools. However, in institutional markets, brokerage companies and banking entities also construct and utilize proprietary currency trading platforms to help satisfy internal needs with trades executed through institutional trading channels.By far the most important parameter for many retail clients is the optionality and pairs available on trading platforms. Advanced trading platforms such as MT4 or MT5 also allow access to a wide range of asset classes available for trading.The development of trading platforms over the past decade has failed to successfully dethrone MT4 or MT5, notably in the retail market. Since the beginning of the retail FX trading business MetaQuotes and its platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5) have been the industry standard, especially when it comes to automated trading.MT4 Shows Resiliency While MT4 has long been seen as ubiquitous amongst brokers’ offerings, a targeted push by MetaQuotes themselves has led to broader adoption of MT5 in recent years. Being the backbone of the company’s offering, a trading platform provides clients with quotes, a selection of instruments to trade, real-time updates on quotes, charts and is the main frontend which customers are facing.Brokers either use existing trading platforms and sometimes customize them, or develop their own platform from scratch. Most commonly, this reflects an online interface or mobile app, complete with tools for order processing.Every broker needs one or more trading platforms to accommodate the needs of different clients.

TD AMERITRADE THINK OR SWIM SOFTWARE

In the FX space, a currency trading platform is a software provided by brokers to their respective client base, garnering access as traders in the broader market. US-based brokerage firm TD Ameritrade, a broker-dealer subsidiary of TD Ameritrade Holding Corporation, has launched a web based version of its thinkorswim® Trading Platform

0 kommentar(er)

0 kommentar(er)